German Microfinance: Flexible Financing Boosts Economic Vitality

In Germany, microfinance, as an important part of the financial system, provides flexible funding solutions for individuals and small and medium-sized enterprises. This type of loan is favored for its fast approval process and flexible repayment plan, and is particularly suitable for dealing with emergencies and short-term funding needs. This article will delve into the detailed characteristics of German microfinance, application conditions, and how they help individuals and businesses achieve their financial goals.

Ⅰ. Overview of German Microfinance

What is Microfinance?

A microfinance refers to a relatively small amount of loans, usually used to meet the short-term funding needs of individuals or businesses. This type of loan has a fast approval process and fast loan disbursement, which is suitable for borrowers who need to get funds quickly.

Characteristics of Microfinance

- Quick Approval: The approval process for microfinance is relatively simple, and the loan disbursement is fast, usually within a few days after application.

- Flexible Repayment Plan: According to the borrower's financial situation, a personalized repayment plan can be formulated to reduce the pressure of monthly repayments.

- No Collateral Required: Many microfinances do not require collateral or guarantees, which lowers the borrowing threshold and is particularly suitable for start-ups and individuals with insufficient credit records.

Ⅱ. Application Conditions for Micro Loans in Germany

The following conditions are usually required to apply for micro loans in Germany:

- Credit Record: A good credit record helps increase the possibility of loan approval, but for micro loans, credit requirements are relatively loose.

- Proof of Income: A stable source of income is a guarantee of repayment ability, and payroll or tax documents are usually required.

- Clear Loan Purpose: The borrower needs to explain the specific purpose of the loan, such as daily operations, equipment purchase, or marketing promotion, which helps the bank assess the risk of the loan.

Ⅲ. Case Analysis

Personal Micro Loan Case

Max, a freelancer in Berlin, needs to buy new computer equipment to meet work needs. Due to the lack of sufficient savings, he applied for a micro loan from an online loan platform. Thanks to the platform's fast approval process, Max obtained the required funds in a short period of time, successfully purchased new equipment, and completed repayments in the following months.

Enterprise Micro Loan Case

A startup in Munich encountered a shortage of funds at a critical stage of product development. The business owner applied for a micro loan through a commercial bank to pay for raw materials and part of the employee's salary. The timely arrival of the loan enabled the company to advance product development as planned, and eventually received an important order a few months later, successfully overcoming the difficulties.

Ⅳ. Institutions and Options for Microfinance in Germany

In Germany, microfinance can be obtained through a variety of channels:

- Commercial Banks: Such as Deutsche Bank and Commerzbank, which provide loan services for individuals and enterprises, usually have a high reputation and stricter approval standards.

- Savings Banks and Cooperative Banks: Savings banks and cooperative banks throughout Germany also provide microfinance. They are usually closely connected with local communities and understand the needs of local customers better.

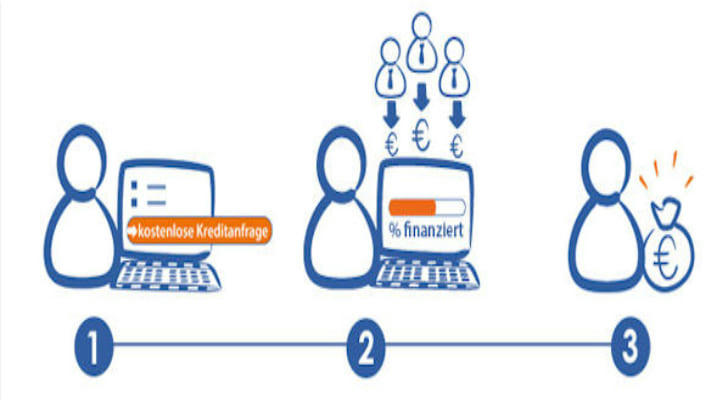

- Online Loan Platforms: With the development of financial technology, online loan platforms provide convenient microfinance services, fast approval processes, and good user experience.

- Government-Supported Loan Programs: The German government supports small businesses and innovative projects through various programs, provides low-interest loans, and reduces financing costs.

Ⅴ. Benefits of Microfinance

The benefits of microfinance are its flexibility and timeliness, which can quickly solve the problem of capital shortage. In addition, the repayment pressure of microfinance is relatively small, which is suitable for short-term capital turnover. For start-ups and individuals, micro loans are an effective means of financing that can help them achieve their financial goals and promote economic development.

Conclusion

The micro loan market in Germany provides individuals and businesses with flexible financing options to help them cope with short-term funding needs. Whether it is personal consumption, emergency expenses, or business operations and expansion, micro loans can provide timely financial support. However, borrowers should also be aware of the associated risks and take appropriate measures to manage these risks. By making rational use of micro loans, individuals and businesses can better achieve their financial goals and promote economic vitality and growth. With the advancement of financial technology and the development of financial markets, micro loans are expected to play an increasingly important role in the German economy.